End of Year Financial Tasks

You can use Gensolve Practice Manager to perform end of financial year tasks.

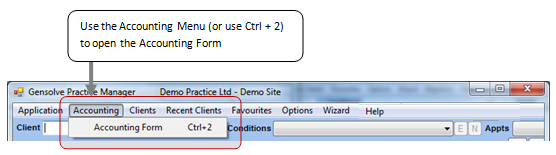

All accounting tasks can be carried from in the Accounting Form (menu Accounting >> Accounting Form or Ctrl+2)

Record all transactions for the financial year

-

- Enter all expenses, sales, payments and receipts that occurred during the financial year

- Ensure all transactions are up to date by reconciling all bank accounts to the end of the financial year

- Run the Uncleared Items reports to check for any outstanding items that have not been reconciled (see Accounting Form >> Reports)

- If you have inventory, create a stock take and manually adjust any closing balances

- Create your GST

Return if required.

Send reports to your accountant

-

- Your accountant may request the following common reports : Balance Sheet, Trial Balance and Profit & Loss Statement (see Accounting Form >> Reports)

- Record any adjustments provided by your accountant as manual

journals (see Accounting

Form >> Chart of Accounts >> Manual Journal

).

Close the financial year

- Create a Period Rollover to zero out expenses and revenue and posts to retained earnings. It is usually created for the end of a financial year once all accounts are finalised. (see Accounting Form >> Chart of Accounts >> Period Rollovers)

- Lock the accounting date so that no transaction can be backdated and affect the reports already sent to the accountant.

- Go to Administration >> Vendors and click Get Data

- Click

to display the Vendor Details window

to display the Vendor Details window - Set the Accounting Locked date to be the end of the financial

year.